Associate Stock Purchase Plan All full-time and part-time associates in the US Are eligible to participate in the non-qualified Capital One Associate Stock. Capital One Employee Stock Purchase Plan. Stock Purchase Plan Own a piece of the Capital One pie Well match 15 of your contribution Education Assistance Financial assistance for tuition. For every 1 that you invest in Capital One stock through the Associate Stock Purchase Plan Capital One provides a match of 1765 cents. May 25 2022 In the US theres a tax-advantaged employee stock purchase plan ESPP under which employees can purchase stock in their companies at a..

Capital One and Discover are both major credit card issuers Each has a full suite of card offerings with various benefits many of which are similar. When it comes to travel credit cards Capital One is the clear winner over Discover Capital One travel credit cards stand out due to their. Discover cards he says are primarily cash-back cards while Capital One offers a variety of rewards cards A merger Robinson says might allow. Capital One Platinum Secured Credit Card The ongoing APR is 3074 Variable APR. In most cases Capital One is a better choice for CDs While Discover has a minimum deposit of 2500 Capital One has no minimums..

Capital One and Discover offer credit cards with overlapping benefits for similar demographics Heres how they compareso you can find. When it comes to travel credit cards Capital One is the clear winner over Discover Capital One travel credit cards stand out due to their travel features and benefits as well as the. In most cases Capital One is a better choice for CDs While Discover has a minimum deposit of 2500 Capital One has no minimums Additionally apart from the one year CD where Discover. One card offers potential deposit flexibility. 1 Discover 79 Overall Score 46 star star star star star_half 869 View Profile Overview Capital One Late Payment Grace Period 15 Late Payment Fee 10 Reward Programs Cashback Time in..

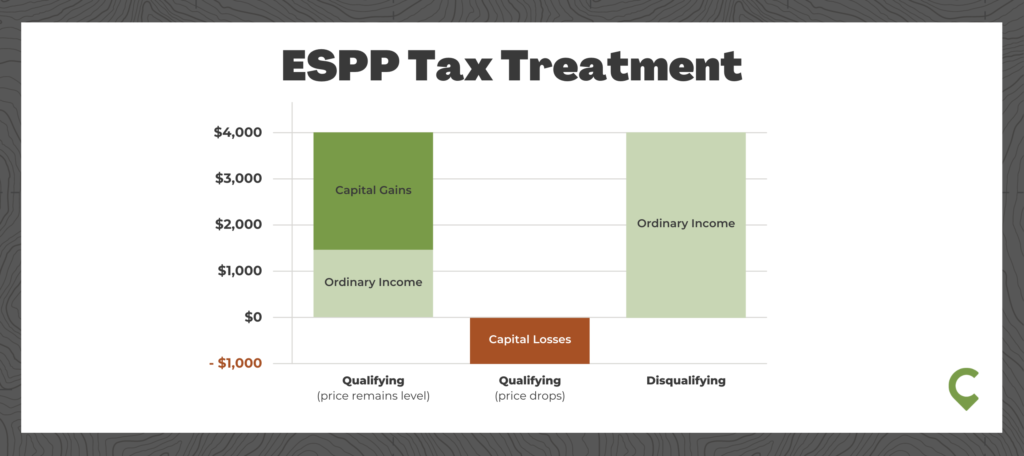

Associate Stock Purchase Plan All full-time and part-time associates in the US Are eligible to participate in the non-qualified Capital One Associate Stock. Capital One Employee Stock Purchase Plan. Stock Purchase Plan Own a piece of the Capital One pie Well match 15 of your contribution Education Assistance Financial assistance for tuition. For every 1 that you invest in Capital One stock through the Associate Stock Purchase Plan Capital One provides a match of 1765 cents. May 25 2022 In the US theres a tax-advantaged employee stock purchase plan ESPP under which employees can purchase stock in their companies at a..

:max_bytes(150000):strip_icc()/Investopedia_ESPP-d8504e55ceef4e7797e4cbb1a6935ee7.jpg)

Komentar